Who Is Reindog in Multiversus? A Brief Guide To Fans’ Confusion

The fluffy and cute character has the heart of a warrior and can do anything to protect his loved ones, and hails from a destroyed world.

After months of rumors and leaks, the highly anticipated game Multiversus from Warner Bros. is finally here. The game is very similar to Super Smash Bros., a fighting game featuring characters from multiple universes and released by Nintendo. Multiversus also features characters from DC Comics, Scooby-Doo, Adventure Time, etc. In the list of characters, where there are well-known characters like Batman, Superman, and Shaggy, on the other hand, there is a completely unknown character Reindog, seeing which the fans have only one question, who is this Reindog?

Who is Reindog?

Reindog is a green and white reindeer with a snout nose, fluffy body, and sharp claws. He has antlers on his head. Reindog is the only character who is not familiar and has not been seen before in either universe. Because of this, confusion has arisen on the internet and social media. Reindog is part of the Zanifeer Royal Family and was entrusted with the responsibility of keeping them safe. He hails from ‘Zanifeer’ which is the real world of Reindog. The official Reindog description of the multiverse game says he is 165 years old and his real name is unpronounceable. Reindog is the sixth wearer of the gem of power.

Lol, absolutely nobody is gonna play as Reindog. https://t.co/kcro3HpOVo

— 🎞️ JeffMovieMan 🎞️ #ElioHype (@JeffMovieMan) November 18, 2021

Zanifeer was destroyed by a being called The Nothingness during an event known as “the great dimensional cataclysm”. In the event, the whole homeworld was destroyed and Reindog was the only survivor. Hoping to bring his family back, he tries to find a way out with the amazing power he has gained from his gem.

Also Read – Elden Ring: Rare Interaction with Melina After Spending 730 Hours in Gameplay

More about Reindog

Reindog is sweet, caring, and protective. He may look fluffy and cute but he has the steely heart of a warrior and will go to any extent to protect his loved ones and those he considers friends.

First look at Warner Bros.'s new platform game titled 'Multiversus' 👀 pic.twitter.com/u3t0suW5TT

— Cartoon Crave (@TheCartoonCrave) November 18, 2021

Many people on social media and the internet were amused by the fact that an original character was included in the well-recognized characters list. One user tweeted a screenshot in which we can spot some prominent characters like Arya Stark, Harley Quinn, Bugs Bunny, and more along with Reindog.

Who the heck is Reindog though #Multiversus pic.twitter.com/G4jrUU85gp

— R͎obP͎layinG͎ames (@RobPlayinGames) November 18, 2021

While some fans are completely clueless about the identity of the fluffy lovable character and expressed their desire to know more about him.

Multiversus game will be available next year via Steam for Xbox Series X & S, Xbox One, PlayStation5, PlayStation4, and as well as PC users. This is a free-to-play game that will be backed by in-game purchases. Fans were surprised to see Game of Thrones Arya Stark in the game, while others were amused by the fact that Batman was voiced by Kevin Conroy and Shaggy by Matthew Lillard, who also voices him in the live-action movie.

Multiversus by Warner Bros. is the second biggest crossover battle game after Nickelodeon’s All-Star Brawl, which came out recently and was nominated for Best Fighting Game at The Game Awards.

Elden Ring: Rare Interaction with Melina After Spending 730 Hours in Gameplay

Video clips from the game Elden Ring give us a hint of Melina’s questionable background, is she real or descended.

The world of the Elden Ring is so cyclopean with its own variety of characters, lots of different weird locations, and events that players often come across some unique phenomenon even after playing for countless hours. Similarly, after playing the game for 730 hours, a player witnessed a strange and never seen before interaction with Melina.

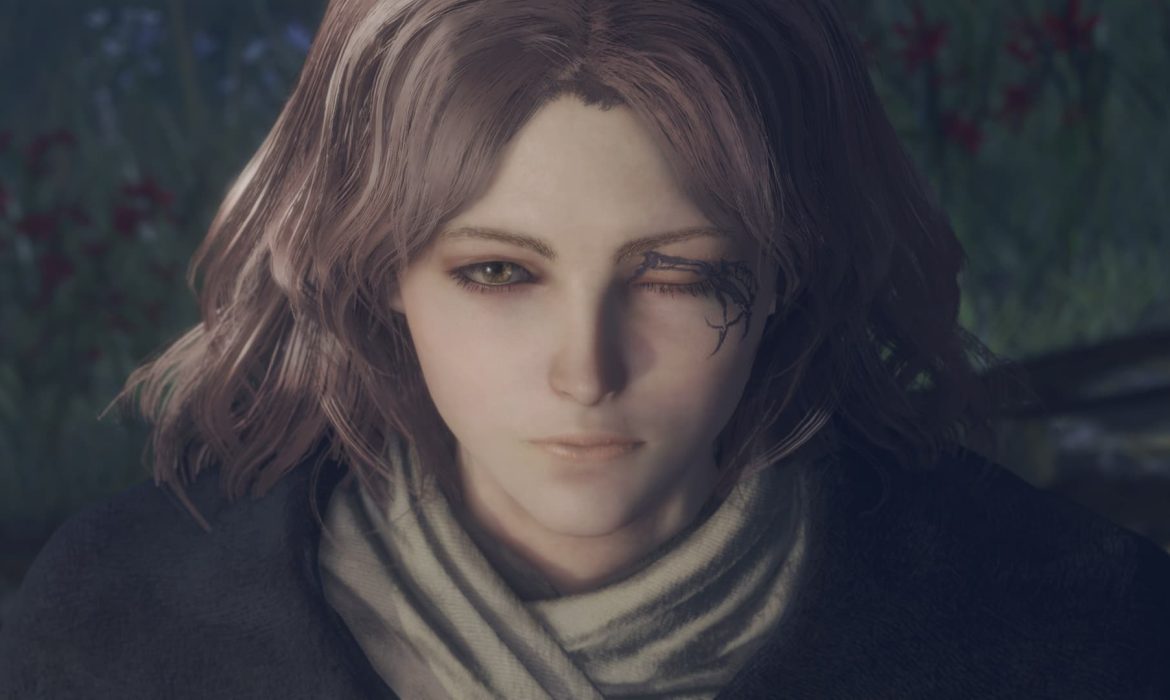

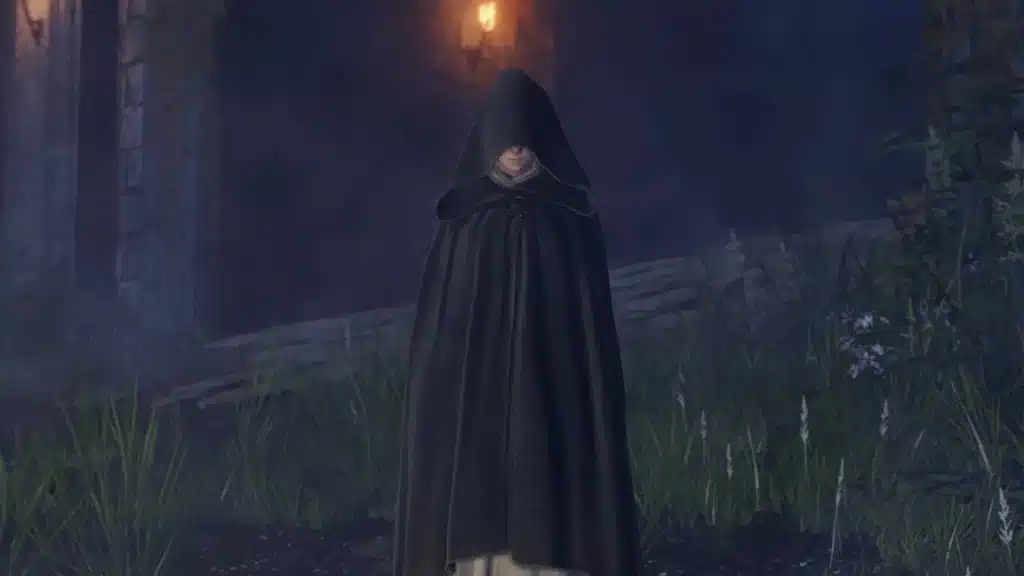

Melina is a non-playing character in the Elden Ring game who guides players throughout the game. She is an enigmatic young woman who appears in the game’s opening cutscene. Melina wears a black cloak and joins the players while they rest at Sites of Grace. She guides players, gives them the ability to level up, and can also teleport players to certain key parts of the game. Melina is the daughter of Queen Marika the Eternal, ruler of the Lands Between and responsible for shattering the Eldon Ring.

Melina: Elden Ring Boss

Reddit user I_AmDaVikingNow and a player from Elden Ring spent 730 hours in the game and ran out of things to see when he saw something strange that no one else had ever seen before. He posted a video on Reddit of a strange interaction with Melina, in which Melina visits the player at the Site of Grace and talks about Boc and his mother. For those who don’t know about Boc, he is a non-playing character who sews clothes and repairs armor for players after completing their quests.

He can also modify players’ clothing and armor. In the video posted by I_AmDaVikingNow, Melina can be seen speaking about Boc, she says that she has seen Boc crying many times remembering his mother, and he needs someone to console him and Tell him how beautiful he is. Everything was fine until Melina asks whether being born to a mother causes such behavior, which puts Melina under suspicion about who she really is and what her background is.

The Elden Ring game has seen a huge rise in popularity over the past few years, with more and more people playing it. The game is huge and there are a lot of little things to be ironed out. In the coming time, we can get to see more such strange things.

Also Read – Resident Evil: Ada Wong’s Storyline Explained Throughout The Franchise

FAQ

Who is Melina in the Elden Ring?

Melina is a non-player character in the game who serves as a guide for players, although her background has recently been hinted to be questionable.

How to save Melina Elden Ring?

To save Melina, you have to find Three Fingers and get the Frenzy Flame from them. For that, you have to go to the basement where you will find a Site of Grace and two doors. One of them will be visible and one will be hidden. You will have to sacrifice your armor in order to enter the hidden door. As soon as Three Fingers gives you Frenzy Flame, Melina will be angry with you and leave forever. You can save Melina by lighting the Erdtree with the Frenzy Flames.

Where to find the Melina Elden Ring?

The Gatefront Site of Grace is the easiest and quickest location to find Melina in the Elden Ring. This place is located north of the Church of Elleh.

HyperX Cloud Core Wireless Headset Review: Affordable Quality Gaming Headset

For sub-100 bucks, the HyperX Cloud Core Wireless Headset is an ideal choice for gamers on a tighter budget

HyperX has been manufacturing gaming peripherals for quite some time now. Their Cloud series headphones are well-loved by esports and casual gamers alike for their comfort and reliability. Even computer manufacturer Hewlett Packard recommends and ships their headphones with their devices. HyperX Cloud Core Wireless is their latest gaming peripheral targeted at gamers who are on a tight budget and want to enjoy headphones without fuss. This headphone does not support Bluetooth connectivity and neither does it have fancy RGB lights. It is a simple headset that comes with a 2.4GHz dongle and can be used on devices that support USB audio output.

Hyperx Cloud Core Wireless Headset Specs

The massive 53mm drivers produce crisp and natural sound that is a feast for the ears of gamers. Audio is transmitted via a 2.4GHz Wi-Fi dongle that is connected via a USB port, the sound quality never drops, nor does it encounter interference. Talking about the sound profile, the bass is deep and punchy, and the mids and highs also live up to the expectations. The game’s dialogues and animal and nature sounds come to life due to the natural sound generated by the dynamic Neodymium drivers.

| Drivers | |

| Driver Size | 53mm |

| Driver Type | Dynamic, Neodymium magnet |

| Frequency Response | 10Hz – 21KHz |

| Drivers Sensitivity | -44dBV |

| Bit-Depth | 16 bit |

| Microphone | |

| Microphone Type | Bi-directional, Noise cancelation, Detachable |

| Microphone element | Electret condenser |

| Microphone Sensitivity | -44dBV |

| Connections & Other features | |

| Audio Control | Onboard |

| Form Factor | Over Ear |

| USB Specification | USB Type-A 2.0 |

| Wireless Range | Up to 20 meters |

| Battery Life | Up to 20 hours |

| Weight | 281g |

| Price | $79.99 |

The microphone is detachable and Discord-certified, so expect nothing less than good noise cancellation and excellent sound capture. Below the left earcup is a 3.5mm line-in jack, into which the earphone connects. The microphone can be removed whenever you don’t need to speak. The Cloud Core Wireless is a plug-and-play affair that does not support aux input and Bluetooth connectivity. Being 2.4GHz, the USB dongle provides a more robust and longer-range audio transmission. Up to 20 meters range, the headphones work well without dropping the connection. Battery life is claimed to last for 20 hours and does not disappoint at all. Despite being constructed from a mix of metal, plastic, and fabric, the headphones fall in the lightweight category with a weight of just 281 grams.

Goods and Bads of Hyperx Cloud Core Wireless Headset

Considering the price, the HyperX Cloud Core Wireless headset doesn’t have too many drawbacks. But if Bluetooth support was given, it could be paired with smartphones and tablets as well.

Pros –

- Good Quality Audio

- Durable, Sturdy, and Portable

- Lightweight & Comfortable to Wear

- DTS Headphone: X Spatial Audio

- No Driver Needed

- Affordable

Cons –

- No Active Noise Cancelation

- Quick wear & Tear on LeatheretteHeadband & Ear Cups

- No RGB

- No Bluetooth Connectivity

Also Read – Astro A20 Wireless Gaming Headset Specs And Review

Final Verdict

The earbuds sit comfortably on the ears and do not hurt even with prolonged use. Had fabric been used instead of leatherette, ventilation would have been better, but considering the low price, we can’t complain. The most important aspect when it comes to gaming headphones is the sound they produce. The 53mm drivers of this headphone handle the mids and lows very well and keep the treble low, which benefits gamers as the sound doesn’t sting the ears and sounds natural.

The sound of HyperX Cloud Core Wireless may not be audiophile level but it is excellent for gaming and entertainment purposes. The wireless connectivity is reliable and doesn’t drop even if there are obstacles in the way for at least 10 meters. If your headphone usage is low then its battery lasts more than 20 hours. The HyperX Cloud Core Wireless is a great choice for gaming headsets under $100.

Resident Evil: Ada Wong’s Storyline Explained Throughout The Franchise

Ada has been one of the most enigmatic characters in Resident Evil history, with her true motives still unknown

Ada Wong, a pseudonym for a mysterious Asian-American spy in the Resident Evil franchise. She has developed a reputation in the business world for being able to handle the most challenging missions and critical situations guiltlessly. She worked covertly in the background of numerous biohazard occurrences, gathering data that was helpful to several organizations while simultaneously working to sabotage them. Wong, however, has frequently deceived the organizations and clients she is linked with in order to pursue her own “real mission” and solely follows it.

Ada has had a very prominent role in the Resident Evil franchise, be it the games or the movies. Her mischievous and inscrutable nature has made her a fan favorite. Ada’s character has evolved greatly over the 25 years of franchise history. All the while, Ada’s true motive remained an unsolved mystery. Her backstory is a huge missing piece of the Resident Evil Universe. Another interesting thing about Ada Wong is that this character has only appeared in even-numbered franchises since Resident Evil 2. Sadly, Ada Wong didn’t return for Resident Evil, at least we can recap the fan-favorite character.

Also Read – What If Your ‘Destiny 2’ Character Got Deleted During Connecting To The Server

Resident Evil 2

Ada Wong was first mentioned in the first game of Resident Evil in a letter written by Umbrella Corporation member John, although she first appeared in the game Resident Evil 2, released in 1998. In Resident Evil 2, Ada was working as a spy for a rival company to the Umbrella Corporation and was on a mission handled by Albert Wesker to steal a sample of the G-virus. During the mission, occasionally helping Leon, Ada sneaks into the NEST laboratory and encounters Dr. Annette Birkin, Dr. William Birkin’s wife. Dr. Annette was responsible for creating the G-virus. Ada manages to obtain a tissue sample from Dr. William Birkin infected with the G-virus.

In Resident Evil: The Umbrella Chronicles, a spin-off released in 2007, we see injured Ada reporting progress to Wesker and flying to Raccoon City in an Umbrella helicopter.

Resident Evil 4

While investigating the Las Plagas parasite in Spain, Ada runs into Leon once again six years after the events of Raccoon City. Ada Wong was still working for a rival company reporting to Wesker and was on a mission to find Dr. Luis Sera in Spain. Ada saves Leon’s life several times, which shows Wesker that she does things on her own terms. Eventually, Sera was killed by Osmund Saddler and Osmund manages to take a sample of the Dominant Species Plaga with him.

Ada was captivated while trying to capture Osmund and Leon rescued her. Together they neutralized Osmund. Ada and Leon then had a fight over the sample and Ada managed to take the sample with her. Instead of giving the original Plaga sample to Wesker, she gave him a sample of the weakened Plaga, making it clear that she does not trust him.

Also Read – ARK: Survival Evolved – You Probably Don’t Know This About Noglins

Resident Evil 6

Ada was a lead character in Resident Evil 6, unlike secondary characters in other parts of the franchise. Ada was still working in the dark, helping Leon and his partner Helena Harper to contain the global virus outbreak. Nine years after the Plaga virus outbreak in Spain, Ada was once again personally involved in a new C-virus outbreak by National Security Advisor Derek C. Simmons. Simmons had created a clone of Ada named Carla.

After being betrayed by Dr. Simmons, Carla founded Neo Umbrella and plans to spread the C-virus to some of the world’s largest cities. Throughout the game, Ada chases Carla while dodging a spiteful and irate gang of BSAA members, notably Chris Redfield, who misidentifies Ada as Carla. Ada teams up with Leon and Helena in China to eliminate Simmons after killing the mutant Carla. She found and destroyed Carla’s lab.

The story of Ada ends with a phone call for another mission which she accepted. It’s been over 10 years since Ada appeared in Resident Evil. Fans are curious to know his further story and real motive. Chris’ character is set to return in Resident Evil 8 and we hope Ada returns as well. Ada is definitely coming back with the rumored Resident Evil 4 remake, if not with RE 8.

FAQs

Who is Ada Wong in the Resident Evil movie?

Li Bingbing played the role of Ada Wong in the Resident Evil movie.

How old is Ada Wong?

Ada Wong was born in 1974. She is 49 years old.

Who played Ada Wong in Resident Evil Retribution?

Chinese actress Li Bingbing played the role of Ada Wong in Resident Evil Redistribution.

10 Things You Probably Didn’t Know About Resident Evil’s Albert Wesker

One of the most notorious and dastardly villains in the Resident Evil franchise, Albert Wesker has an interesting past. Albert may return in upcoming Resident Evil projects as he has been mentioned several times even after his death long ago.

The infamous Resident Evil villain, Albert Wesker gave Chris Redfield a tough fight through all of their encounters. With superhuman strength, lightning speed, intelligence, and a hunger for power, Albert Wesker is a very cunning and deadly foe. With his sharp wits, he can prepare covert missions. Had it not been for Redfield, Albert Wesker would have pushed the planet into a catastrophic situation. Like all the other favorite villains, Albert Wesker has a strange past that has made him stronger.

We’ve listed 12 things I bet you didn’t know about Albert Wesker from Resident Evil, that will help you better understand this character and some of them might surprise you.

10. Albert Wesker and William Birkin were schoolmates

Albert Wesker and William Birkin studied together and worked at Umbrella, but later parted ways. When Umbrella tried to steal William’s research, he injected himself with the G-virus and it spread throughout Raccoon City. Leon and Claire later finish him off.

9. Albert Wesker may be his pseudonym

Dr. Spencer began the Wesker Project, in which he aimed to create a new race of gods that would replace humans in the future. All the children who were included in this experiment were given the surname Wesker.

8. Wesker finished a Ph.D. in Virology at just 17

All hail to his sharp intellect and money, Albert earned a Ph.D. in virology as a teenager, which made him a desirable candidate for the Umbrella Corporation. He was one of the few researchers to work on immortality with Dr. Spencer.

Also Read – Top 6 Tech Trends in 2023 You Should Be Thinking About

7. Albert faked his death

Wesker was killed by the same tyrant he had unleashed on STARS. However, before he died he injected himself with a prototype virus. That virus not only brought him back to life but also made him super powerful, lightning fast. He also has healing powers. He already had combat skills, but with new powers, he became even more dangerous.

6. Never faced Leon Scott Kennedy

Despite the prominence of both in the franchise, Leon and Albert have never had a face-to-face encounter. Wesker tells Wong to kill Leon. Later, due to the worsening of the situation, he handed over this work to Krauser.

5. Worked as a double agent

Albert Wesker was a senior researcher on Biological Organic Weapons and the T-virus. He questions Dr. Spencer’s motives and then leaves the project. After that, he worked as a spy in the US Army and Umbrella’s private army. Later cheated both and joined a third rival company.

4. Did business with drug dealers

Javier Hidalgo was the boss of the Sacred Snake drug cartel and a longtime buyer from Umbrella corporation. Albert Wesker sold him bio-weapons.

Also Read – Alienware Aurora 2019 Review: Impeccable Design With High-End Performance

3. Wesker had an illegitimate son

Jake Muller, Albert’s illegitimate son, lived with his mother in Edonia. Later he started working as a mercenary soldier who only meant money.

2. Believed himself the saver of the earth

Albert Wesker considered himself a hero who felt that humans were on their way to their destruction and he was saving them. He was supposed to work on immortality with Dr. Spencer to create a superior human race, but he decided to become a god himself.

1. He has an equally evil sister

The most talented of the Wesker children and his sister, Dr. Alex Wesker, held high positions at Umbrella Pharmaceuticals. She betrayed the Umbrella Corporation and pretended to be a goddess, succeeding in ruling over the island of Zabytij where the inhabitants worshiped her.

FAQs

Who is Albert Wesker?

Albert Wesker, a scientist and a notorious villain in Resident Evil gained superstrength and speed after injecting himself with a prototype virus.

How old is Albert Wesker?

Albert Wesker was 38 years old when he was the captain of STARS.

Who is Albert Wesker in Resident Evil?

Albert Wesker might be a part of the Wesker project started by Dr. Oswell spencer. He was a scientist-turned-villain.

How did Albert Wesker get his powers?

Albert Wesker injects himself with a prototype virus just before being attacked by the tyrant. The virus resurrected him and granted him superpowers.

Fintech Use Cases and How It Complements Traditional Banking

If banks and fintech companies are pitted against each other, traditional banks will win the number game, but fintech is arguably the future of banking. Can these two forces coexist?

People’s dependence as well as reliance on mobile banking channels has grown by 20-50% since the pandemic according to a report by McKinsey. People have accepted online banking wholeheartedly and technology-based remote banking is decidedly the future of banking. Traditional banks and financial institutes have woken up to the fact that financial technology is all set to replace them as primary channels of credit and investment. Surely, in the last couple of years banks and financial institutes have taken a lot of bold steps in terms of integrating technology into their processes, making branchless banking, and agentless transactions more accessible.

Is there some kind of tension between fintech startups and banks? The competion that disruptive fintech startups have introduced has actually done a lot of good for consumers since it has forced the banks to improve their services. In fact, the competition right now is more between fintech startups than between fintech and traditional financial institutes.

What drives the growth of Fintech?

Speed comes to mind right away. Fintech has removed the geographic hurdle between consumers and financial services. There is hardly any physical step that a consumer must go through in order to complete a transaction or even a KYC. If there is at all a need for physical interaction, it is usually representatives of the fintech services that do the traveling and the meeting at the consumeres; convenience. This is the kind of service the modern consumer is getting used to and they are not going to settle for any less.

Speed aside, what drives fintech is the focus on user experience. The applications are getting better and better. You get wealth management and financial advice as complementary services right under your finfger tips.

Thanks to fintech, you can complete a transaction on an eCommerce channel like Amazon in seconds. No wonder, the consumers are less prone to going back to time consuming financial transactions through traditional mediums. 25% of the consumers want a fully digitized banking experience according to another report by McKinsey.

Also Read – 5 Robotic Process Automation Tools to Streamline Your Business in 2023

Key use cases of Fintech

Online payment gateway: The infrastructure that allows merchants to accept payment for their products and services through the internet securely.

Mobile payment app: A mobile based application that allows sellers to accept electronically transferred payments without investing in hardware.

Crypto exchanges: Cryptocurrency is yet to be accepted globally as formal tender, but it is used in quite a few places and it depends on fintech.

How are banks reacting to the emergence of Fintech

Banks and financial technology are parts of the same industry. In fact, the usage of financial technology was reserved to traditional banks and financial institutions up till the early 2000s. The technology was used to strengthen their backend processes. Now that fintech startups are using technology to enhance customer experience, banks are reacting in two ways. A) acquiing fintech startups. B) Adopting tech-driven practices.

Finance had never been so easy and accessible for the consumers as it is now, thanks to the fintech industry. Whether we will see banks become obsolte or fintech companies merge with banks, only time will tell.

Fintech vs Financial Services: Who’s Ruling The Market?

Banks and traditional financial services hold a much larger chunk of the market than the fintech industry. But the latter is catching up fast.

In 2021 the overall worth of the financial services industry was $23,319.52 billion while the fintech activity reached $210 billion. The comparison between these two might seem unrealistic at the outset but bear with us as we unfold the strands of the relationship between banks, fintech services, and the economy. Let us first locate the key differences between a bank and a fintech company.

What Segregates A Bank From A Fintech Company?

Banks and fintech firms differ in many things and they have yet more things in common. But the main point of difference is in the mode of lending. Banks engage in ending directly with the borrower and fintech platforms orchestrate a peer-to-peer lending operation between the borrower and the lender or investor. The mode of lending aside, what segregates banks and fintech companies is the speed of transactions and the involvement of physical steps.

What Does Peer-To-Peer Lending Do For The Market?

Peer-to-peer lending does two very significant things. A) it democratizes credit. Makes credit more accessible, especially to low-income groups. B) Creates serious competition for banks and traditional financial institutes, while also complementing their services in a way by catering to a population that fails to acquire a loan from a banking and financial institute.

Where Else Is Fintech Winning?

Technology is the main strength of the fintech industry. It has done two things with its technological prowess. Firstly, fintech companies have made financial transactions easy and made cashless transactions the norm. There is a sheer lack of demand for cash in the USA. If you add to that the more disruptive ways of transactions like cryptocurrencies, things lean even lower on fintech’s side.

Removing Bias From Lending Services

Fintech companies use machine learning-powered algorithms to analyze credit profiles of individuals to decide how much credit a person should receive, if at all. The process removes loan officers from the middle along with the biases that come with human mediators. This definitely democratizes the whole process.

Also Read – 5 Robotic Process Automation Tools to Streamline Your Business in 2023

How Are The Banks Reacting To It?

Banks and traditional financial services have realized very well that technology is the future of financial services and the big players have started by buying fintech companies to enhance their own technological standing. For instance, JP Morgan Chase bought InstaMed, a healthcare-based fintech company. Fintech companies have pushed banks to integrate technology into their systems. More and more banks are now accessible through mobile apps for branchless banking.

The Downside Of Fintech

The fintech industry is growing fast and speed often comes at the expense of security. Security risks are a real threat for fintech firms and it’s something they need to get under control fast. The usage of cryptocurrency in illegal trade is another matter of concern. 46% of all Bitcoin-based transactions are made on the dark web. Another issue is that the mining of cryptocurrency requires enormous amounts of energy.

Bottomline

The numbers clearly suggest that the fintech industry has a long way to go before it catches up with banks and financial services. Nevertheless, race is one and fintech is pushing the traditional institutes. Maybe in a few years it will be difficult to segregate the traditional and the fintech approach to banking.

A Digital-First Future Seems Distant as BBC Grapples with Fund Cuts

BBC management wants to prepare for a digital-first future but they’re hard-pressed to compete against tech giants like Netflix.

Netflix spends £1.7 billion per year on technology alone to keep the OTT platform running as well as it does. BBC’s budget for technology that runs underneath its internet-based broadcast platform was £98 million in 2022. These figures show how far behind BBC is in the race for dominance in the OTT market. BBC still spends 88% of its resources on the television and radio broadcasting infrastructure. So, while Tim Davie, the director general of BBC, has announced their long-term plan to switch the radio and television-based services to internet-based services completely, very little work has actually gone into it.

When BBC first launched the internet-based iPlayer, it was pioneering. So much so that Reed Hastings, the CEO of Netflix actually credits BBC with laying the foundation for a service like Netflix. Over the years the British Broadcasting Corporation has struggled to keep up technologically with players like Netflix and Spotify. The nationalized company just doesn’t have the resources to compete.

What really makes the difference between the BBC and Netflix is their capability to offer a personalized experience to their audience. Netflix has poured money into analytical research. It currently runs one of the most sophisticated data science operations just to understand what a particular member of the audience wants to watch. The recommendation engines take a lot of things into account and nail it pretty much every time. iPlayer does not know how to differentiate between a person who likes thrillers and a person who likes sports.

Also Read – EU Strikes a Deal with Hungary Freeing Up Funds for Ukraine

What Netflix has achieved takes a lot of technological prowess Same goes for Spotify. These companies have hired and retained the best technical talent and they will keep doing that in the future because they can afford it and they depend on it. BBC cannot afford to pay highly skilled technology professionals who can bring its OTT game up to the level that the young audiences are used to. The result is quite obvious. Netflix and Spotify are twice as popular as iPlayer or Sounds. BBC has completely failed to penetrate the age group of 16-34, the main body of the OTT audience.

Being a company funded by the state, BBC does not have access to the millions it needs to survive the disruptive market. The corporation has endured fund cut after fund cut over the last 12 years of conservative governments. The latest blow was sustained when Nadine Dorries put a freeze on the license fee for two years earlier in 2022. At this rate, BBC might be stuck to entertaining only an older audience and then, slowly move towards obsoletion.

A BBC spokesperson said: “The NAO finds the BBC’s digital performance is impressive with more people coming to iPlayer, Sounds, and our online services than ever before, but there is more to do. We’re driving digital reforms across the organization to provide people with the BBC content they want, in the ways they want it.”

Whether they will manage to assemble the resources needed for such reforms is a different question altogether.

Best 9 Tips To Perfect Your Marketing Resume

A standout resume gets you ready to sell yourself. Resume is the first contact with an employer and that must be convincing enough, especially in the marketing field.

Resumes are your first contact with an employer and are very important in every field. But, in marketing, it’s not only the first contact, it’s also your first work sample. After all, you are applying for a marketing job, you must know how to market yourself. You are going to work which should stand out among others, so, your resume.

You Can Follow These Steps To Make A Perfect Marketing Resume:

1. Use A Noteworthy Resume Template

Hiring managers see a lot of resumes that look the same at once. Choose a template that stands out and grabs attention. Use some design elements that make your resume unique and compelling to the eyes.

- Colours – Keep the main text black, don’t go crazy. You can use subtle colours in headings and some text you want to highlight.

- Font – Keep the font simple and readable. Using different fonts for the heading and body will definitely improve the readability and overall look of the resume but don’t go too “Creative”.

- Two-columns – Two-column design will help you put more information without cluttering. A single column will look ancient. Columns are easy to read too.

2. Mention Required Skills Only

A resume should have a skills section, but it shouldn’t be cluttered with useless skills. Having knowledge of Microsoft Office has nothing to do with marketing. Keep the skills section to a minimum by only mentioning skills relevant to marketing. Some companies are using screening software these days. The software searches for some specific keywords, if they do not find those keywords, there is a good chance that no real person will even see them. Mention these three things:

- Proficiency in specific skills/techniques – List specific marketing skills such as content marketing, video editing, lead nurturing, web designing, etc. Again don’t clutter the section with useless skills. List skills related to the job you are applying for. If you’re applying for SEO, mention skills like keyword research and backlink building. Don’t forget to mention other skills relevant to the company; You never know what additional skills a company might consider as a bonus.

- Proficiency in specific software/tools – Lists all the software and tools that have mastery in the above-written skills. For example, if you’re a video editor, list all the important software you’ve mastered. Also, check the job description posted by the company to see if they need a candidate who is experienced with a specific piece of tool.

- Proficiency in operating systems and coding languages – List any programming and coding languages you know. Don’t forget to mention any operating systems you know to run.

Also Read – 5 Marketing Strategies for Faster Growth of Your Business

3. Add Stats And Figures

Every hiring manager wants to see solid evidence of your previous performance. So, don’t forget to mention your results from the last role. For example, mention how much traffic you brought to the website by SEO, growth in email subscribers and conversion rates, reduction in operation cost, etc.

4. Keep The Education Section Short And Minimal

List your degrees, when, and where you got them. Do not include your grade points, minor academic awards, clubs and societies membership, or studying abroad schooling. This will look amateurish, until unless you are applying for an internship. The company you are applying to needs your skills, not your academic achievements. 95% of hiring managers don’t care about your grades. Getting A grades in studies doesn’t mean you will perform similarly in a job too.

5. List A Few Hobbies

Mention a few hobbies only if you have room on the first page. Your hobbies will help the hiring manager to identify your personality.

6. Include Important Links

Listing important links to your work will back up your claims. You can claim anything on a resume, but if you have proof, your claims will solidify. You can add your LinkedIn profile. Manage your LinkedIn profile and make decent connections. If you are applying for a development, design, writing job, etc mention links to your work. Don’t forget to mention your personal blog or company’s blog in which you were involved. You can add links to contributed articles as well.

7. Keep It To A Single Page

Unless you are applying for a job where they are looking for 10+ years of experience, cut down the information to the extent that fits on a single page. Putting too much information on multiple pages will suck up the time of hiring managers and your chances of getting hired will go down. Follow these simple steps:

- Use two columns, which will help put more information in less space.

- Only include the last two-three jobs or relevant jobs. If your earlier positions are not relevant, skip them. Nobody is interested in knowing that you were a part-time waitress in your college days.

Also Read – 7 Startup Ideas That Could Actually Work in 2023

8. Add A Summary Sentence At The Top

Add a personalised summary sentence on the top of the resume to describe what you can do or why you want this job. Then Add a summary if the application doesn’t allow adding a cover letter. If they do so, consider adding a short personalised cover letter.

A good example of a summary is “Self-motivated video editor with three years’ experience, proficient in Adobe Premiere Pro and Sony Vegas Pro, aiming for challenging projects”. A small summary will describe a lot about you and will also differentiate your resume from others. Don’t write like, “I’m looking for a full-time position for a video editor.” Duh, there is no need to write the position you are looking for.

9. Add A Cover Letter

Resumes are made simple and to the point. They sometimes do not tell you everything about you, so supplement the resume with a personalised cover letter. Follow these do’s and don’ts:

Do’s

- Mention why you are interested in this particular position.

- Highlight two-three relevant elements of your work experience.

- Write your cover letter by yourself. This will reflect your personality. Copy-pasting will not do.

Don’ts

- Don’t mention you are interested in this job. (That’s why you are applying, isn’t it?)

- Don’t use slang and fancy-sounding words. Keep it formal.

- Don’t exceed two-three small paragraphs. Hiring managers are busy, they will ignore long texts.

- Don’t mention that you are doing this job to build experience for the future. They are searching for employees not trainees.

After designing your resume, proofread it multiple times. Your resume should be of high quality. Consider making it in PDF format rather than JPEG or PNG.

How Blockchain Can Transform the Financial Services Industry

Blockchain technology is a shared and immutable ledger that is secure and transparent. The technology creates a decentralised database that cannot be tampered with and is said to have the potential to revolutionise the way we interact digitally. Blockchain technology is leading in the finance industry promising quick trades and secure transactions, reducing fraud. Ultimately eradicating risks within interconnected international financial systems.

Blockchain is designed to resist hacking and tampering with the help of advanced cryptography, safeguarding transaction systems. Besides keeping a check on trades and transactions, there are many uses of blockchain in finances. As the global financial system is becoming more and more digital, financiers and investors need to learn about blockchain. They must know about earning potentials, and risk factors tech-oriented startups are posing in the traditional banking system.

What is Blockchain?

Blockchain is a digital ledger of transactions that are recorded in a decentralised network. It is a shared digital collection of transactions that don’t have any central authority, which means no one entity or person can control the records and intervene in the data. The blockchain is made up of individual blocks(sets) of data, which are interconnected in chronological order.

These blocks can’t be changed which ensures tamper-proofing and establishing confidence in the network. If somehow, the data of one block is changed so that it will not match the other linked blocks, eventually the tampered data will be discarded. Blockchain manages transactions by securing data in all linked blocks as soon as it takes place. The purpose of blockchain in finances is to reduce costs and improve efficiency.

Also Read – 4 TED Talks That Show How Blockchain Is Changing Business

What are the Benefits of Blockchain in Financial Services?

Blockchain promises more transparent, tamper-proof, and efficient financial services.

Security

As everything is turning digital, online frauds are also on the rise. The intensive activities of users on the Internet have become a breeding ground for fraudsters. Blockchain technology promises to solve this concern. Payments on the blockchain are more secure and traceable than the old-school banking system.

In the traditional banking system, information flows through multiple intermediaries which are prone to the interference of data, which increases the chances of tampering and fraud. The holes in the boat can be filled with the cryptographic algorithms of the blockchain which is secure from hacking and tampering and brings security to the exchange of information.

Transparency

Blockchain’s most important feature is transparency as the user’s transaction activity is recorded in a public ledger. Transparency immediately exposes fraud which leads to a risk-free financial environment for financial institutions. Every block in the link has a copy of data throughout the network. Each time a new transaction takes place, everyone in the network will receive a copy. The system is designed in such a way that it shares the same information with everyone.

Cost-effective

This innovative technology allows investors to get more of their money cutting down costs associated with traditional financial services. Higher fees for financial advisors are a big turnoff for an investor. Blockchain technology eradicates this concern also.

Financial Technology companies are becoming a huge part of the financial industry nowadays. FinTech companies are allowing investors to open a free account and take independent financial decisions. As FinTech companies are playing a stronger role in finances, their relationship with blockchain is also becoming stronger.

What are the Risks that Blockchain and Financial Institutions are Facing?

To transfer money, the consumer has to depend on the bank for the transaction. Banks earn money from transaction fees. The adaptation of blockchain will bypass the need for banks which will eventually eliminate transaction fees and other associated costs. As a result, banks will face a decline in transaction-based revenue.

Blockchain innovation is moving at such a rapid pace that regulatory bodies have not implemented full control over it. Certain policies are creating barriers to the inclusion of blockchain into financial services. Regulatory bodies are monitoring and analysing the benefits and risks of blockchain technology in finance to see how it will impact companies and consumers.

Which Blockchain Investment to Buy?

An investor who wants to get involved in blockchain finance has a few investment avenues.

One way is to buy shares of the companies that are involved with blockchain technology. International Business Machines Corp. (IBM) falls into this category. IBM is associated with the development of blockchain technologies. They are also providing blockchain integration services to the business for scalability, efficiency, and growth.

Another way is the investment in cryptocurrencies. Cryptocurrencies work purely on blockchain technology. MicroStrategy Inc. (MSTR) is a software solution company that holds 105,000+ bitcoins (a type of cryptocurrency) which is valued at more than $5 billion.

Square Inc. (SQ), a payment services company is about to launch a decentralised finance platform focusing on Bitcoin applications.

Investing in these companies allows investors to invest in cryptocurrencies without having direct exposure to them. MicroStrategy is up about 80% while Square is up about 23%.